So, you got an audit letter from the IRS in the mail….the one thing you probably didn’t want to get. First of all, don’t panic! Take a deep breath and take a step back for a moment.

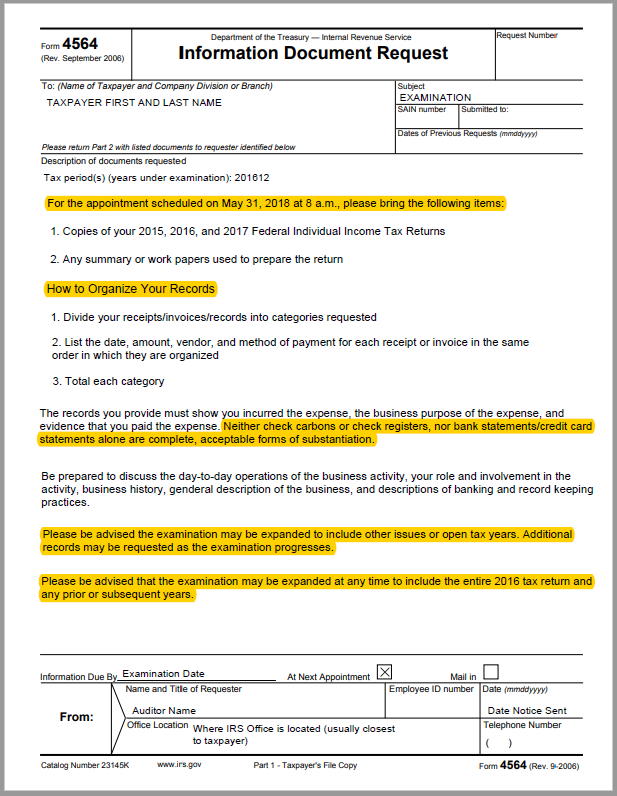

Let’s talk about the letter first. It’s usually what we call a laundry list of items that the IRS is requesting for one or more tax years. This is called an Information Document Request and is known as a Form 4564.

They usually have everything listed by category (note that the specificity and outline will depend on your auditor and how they choose to present the information). They will give you a time and date to meet. This is typically the day they also expect the information requested to be gathered and presented to them (some may request it ahead of time, so that they can review it beforehand). Again, don’t panic, even if they are asking for a lot of items. Break. It. Down.

We are going to dive into an example form now, go over some things to look out for, and tips for what to do and how to get started.

We are going to start with the highlighted parts on page one, because these are items you really need to pay attention to:

- For the appointment scheduled on May 31, 2018 at 8 a.m., please bring the following items:

The date of the examination should be one of the first items you see on the form. Make sure you always stay on top of that date: write it in your planner, set multiple alarms and reminders in your phone, whatever you need to do! That is one date you definitely don’t want to miss.

- How to Organize Your Records

Each auditor is different. You may get one who asks for the bare minimum or you may get someone who is super detail-oriented. Pay attention to how they want the information presented. We think Excel sheets and colored dividers for the information makes everything look organized and professional. It might sound silly, but presentation actually matters A LOT! Auditors see literally every kind of way people gather their information. Whether it’s you or your representative putting together everything, make sure it’s clear and easy to comprehend.

- Neither check carbons or check registers, nor bank statements/credit card statements alone are complete, acceptable forms of substantiation.

A lot of people assume they can get away with just submitting bank or credit card statements but that is NOT the case. Yes, the IRS will still want those, but they also want to see more detailed information for purchases. Bank statements (especially depending on where you bank) can be really vague and sometimes totally confusing to decipher (ever notice how some purchases don’t even show the store location by its actual name?). The main take-away here is KEEP EVERYTHING!!! Don’t throw away your receipts or invoices. In fact, make copies (receipts can fade over time), scan them and keep them in a file on your computer, and keep documents stored in a safe place.

- Please be advised the examination may be expanded to include other issues or open tax years. Additional records may be requested as the examination progresses.

- Please be advised that the examination may be expanded at any time to include the entire 2016 tax return and any prior or subsequent years.

That’s right, they can expand their search during the examination. This may be more records (they may decide to look at other categories) or other tax years. Only give the information they are asking for. They didn’t ask for supplies? Don’t give information on supplies unless they expand the scope of the audit. This is where representation and assistance with an audit might be important. Professionals have been through this process and know what auditors will ask, so they also know what not to say.

The items listed on page two are examples of how different categories may be presented to you and what specific records an auditor might want for those categories. After reviewing these you may think to yourself, “Where do I start??” Keep these in mind as you get started on the process:

- Do I have the records the IRS is requesting?

- Can I get my hands on anything I don’t have readily available in a quick manner?

- Can I handle this on my own or do I need some help? (there is no shame in asking for help. We have literally had clients box up all of their records for the year being examined and mail them to us to sort through and handle; that’s what we are here for!)

There are important things you can do right away:

- Gather necessary records, receipts, etc. and start putting them into categories and by date.

- MAKE AT LEAST TWO COPIES OF EVERYTHING AND DON’T SEND THE IRS THE ORIGINAL DOCUMENTS! (there is no guarantee you will ever get those back)

- If you do hire someone to assist, make yourself available during the day as they work on everything. They will have questions, it’s inevitable. Also don’t be scared to ask for a copy of what they are sending, these are your taxes.

- If you’re handling everything yourself, remember that organization gets you farther than you’d think. Separate categories with tabs or colored paper, make Excel sheets (or at least neatly hand written ones) with totals. If the auditor has an easier time going through items, more times than not it will also makes things easier on you (or your representative) during the meeting.

- They will ask you questions about your daily activity (especially if you have a business), they may ask about your assets, or certain expenses, so go in prepared and level-headed.